Updated July 11, 2024

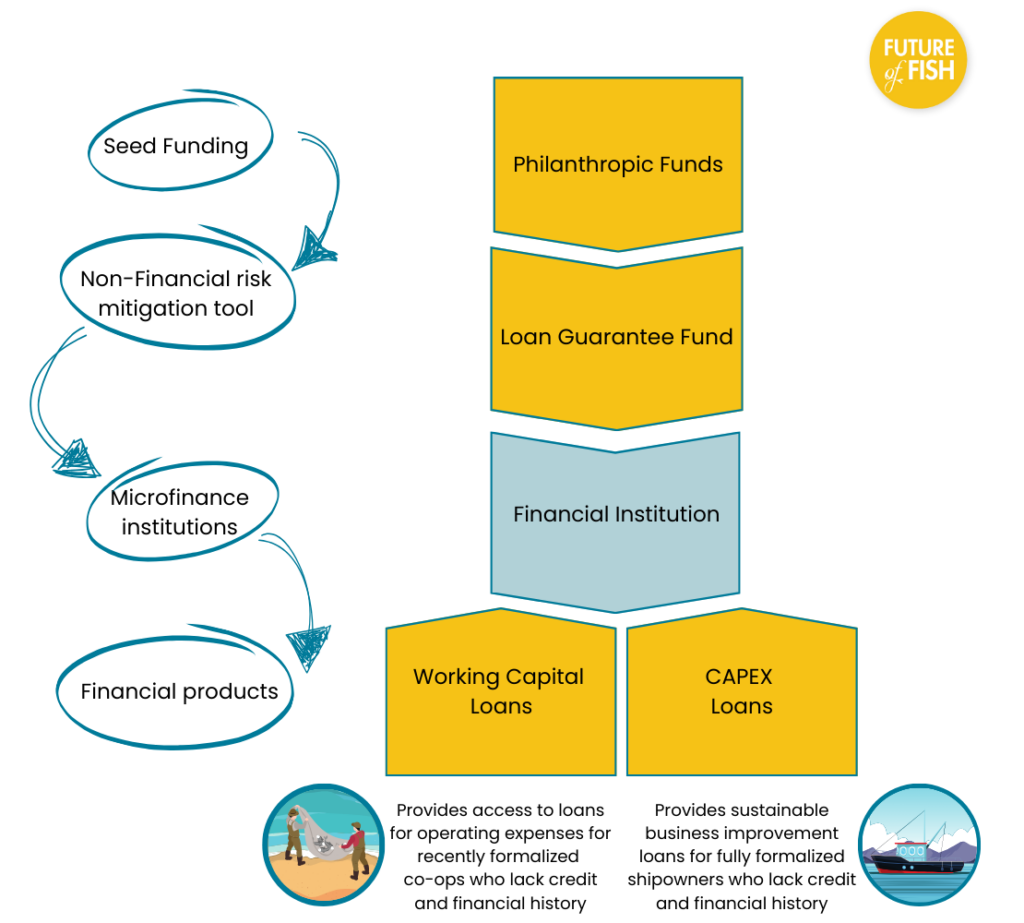

Future of Fish and partners are excited to announce the Artisanal Fisher Development Fund (the Fund), a pilot loan guarantee fund to facilitate access to credit to support formalization, sustainable practices and financial inclusion amongst Peru´s artisanal fishing sector .

The Fund aims to facilitate access to credit for working capital loans through aggregated purchase programs of Coops for inputs such as gas, ice, oil, and other fishing essentials the savings of which will be passed on to fisher members supporting reduced operational costs and increased profit margins. Presently, some Coops are mobilizing members’ monthly contributions to purchase inputs like oil and giant squid fishing jigs. Loans from financial institutions, will complement these efforts with the aim of providing a wider range of inputs to fishers at more competitive prices. Working with Coops enables financial institutions to reach a vast number of fishers while reducing origination costs and mitigating individual risks. By the same token, strengthening artisanal fishers’ Coops increases their agency and governance capacity thus enhancing their ability to make sound business decisions that support responsible fishing and local socio economic development. Aggregated purchase services provided by Coops increase members’ loyalty and incentivize them to continue contributing to growing the members’ fund thus creating a virtuous circle of Coop capitalization and reduced dependence on external sources of finance.

In addition to facilitating aggregated purchases, the Fund also aims to support access to CAPEX loans to facilitate the adoption of technologies, like GPS devices, radio beacons, four-stroke engines, and others, that help reduce costs and environmental impacts, support traceability, and promote safety-at-sea while complying with national and international regulations.

Artisanal Fisher Development Fund structure

What does this pilot mean to artisanal fishery coops?

As José Mario Fiesta Flores, Manager of Cooperativa Pesquera, San José Limitada describes: “The work we are doing with Future of Fish, through the Fund, is very significant for our cooperative, since the aggregated purchases program will benefit all associates. This is innovative for us because, within Peru´s artisanal fishing sector, nothing like this has been done in the past. Moreover, this pilot project will also support us to adopt good sustainability practices. Thanks to this project, we will also improve our managerial and financial capacities, including keeping proper accounting and fiscal records as well as producing financial statements, so in the future we could use them to apply for credits with private and government financial entities.”

Sourcing inputs from formal providers promotes efficiencies and supports compliance with fiscal regulations due to better product quality, higher performance and receipt-backed purchases that can be tax deductible.

Over the pilot period, Future of Fish will be assessing the effectiveness of the Fund in order to graduate fishers and coops to be able to access formal finance independently using their own assets. The partners will specifically assess the potential of using fishers´ fixed assets (such as boats, engines, and gear) as collateral for future loans. Other alternatives, like mobilizing credits against purchase orders and/or letters of intent of purchase will also be explored with like-minded seafood buyers and processing plants.

At the conclusion of the pilot, we hope that the Fund begins to demonstrate that artisanal fishers and cooperatives can represent a tangible asset class to financial institutions with the potential to grow into a profitable economic sector while helping to bridge the financial inclusion gap in the artisanal fishers’ sector. We believe that facilitating this access to credit for Peru´s recently formalized artisanal fishers, coops, and associations is an essential step to ensure responsible business practices that support improved fisheries management, contributing to reduced IUU fishing.

For more information on the Artisanal Fisher Development Fund, please contact Luis Miguel Ormeno at lormeno@futureoffish.org.

Glossary of terms

CAPEX Loans

A loan that must be used for capital expenditure (physical assets such as land, buildings and equipment).

Four-stroke engine

Internal combustion (IC) engine in which the piston completes four separate strokes while turning the crankshaft. A stroke refers to the full travel of the piston along the cylinder, in either direction. Four-stroke engines produce less pollution and noise as well as being more efficient than two stroke engines.

Governance

The process of making and enforcing decisions within an organization or society. It encompasses decision-making, rule-setting, and enforcement mechanisms to guide the functioning of an organization or society. Effective governance is essential for maintaining order, achieving objectives, and addressing the needs of the community or members within the organization.

Radio beacon

Radio beacons transmit a continuous or periodic radio signal with limited information (for example, its identification or location) on a specified radio frequency. Occasionally, the beacon’s transmission includes other information, such as telemetric or meteorological data.

Working capital loans

Refers to a loan that is availed of to fund the day-to-day operations of a business, ranging from payment of employees’ wages to covering accounts payable. Not all businesses see regular sales or revenue throughout the year, and sometimes the need for capital to keep the operations going may arise.

Published Jun 25, 2024